A frequently asked question, often only considered in the moment,

is: Will a non-fault accident impact my insurance?

Ensure transparent and consistent communication with policyholders regarding their claim status and the rationale behind any decisions.

Always remain at the scene of an accident, regardless of how minor it may seem. Leaving could lead to legal issues and complicate the claims process.

Don’t depend on receiving a replacement vehicle right away. If you don’t make arrangements for alternate transportation on your own, you might find yourself without a way to get around.

The Accident Management market prioritizes the non-fault driver’s best interests by providing services that help them claim costs and losses from the at-fault driver’s insurance policy.

As the Accident Management market remains a better option for non-fault drivers, the insurance industry works to control and manage non-fault claims and processes.

As the Accident Management market remains a better option for non-fault drivers, the insurance industry works to control and manage non-fault claims and processes.

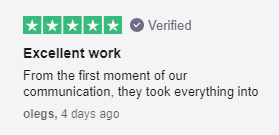

Showing our 4 & 5 star reviews

Overlooking Impact on Premiums: Be aware that using your own insurer for a non-fault claim can increase your premiums, affecting your future insurance costs.

By avoiding these actions, you can better protect yourself from potential financial disadvantages following a non-fault accident.

Ignoring Alternative Options: Always consider third-party claims services that specialize in non-fault accidents to avoid potential financial drawbacks.

Official Documentation: Ensure that the accident is reported to the police and obtain a copy of the police report. This report can be critical in establishing fault and supporting your claim.

Firstly, if you choose to claim directly through your own insurance policy instead of working with an accident management company when the accident was not your fault, you may face a significant increase in your premium at your next renewal due to the pending claim against your policy.

Since the accident claim has not yet concluded, your own policy could still be held liable for the accident. As a result, you may need to pay the increased premium to maintain your insurance coverage.

Secondly, once the claim is concluded and you are officially documented as the non-fault driver, some insurance companies may still consider a non-fault accident as a risk. Consequently, they may calculate an increased insurance premium based on their risk assessment of your policy.

If the accident was not your fault, you will still need to pay your policy excess if you choose to process a non-fault claim directly through your insurance company.

However, if you work with an accident claims management company for your non-fault accident claim, you will not have to pay any excess or costs..

As part of the accident claims management service, the claim will be processed directly with the at-fault party’s insurance company.

If the accident was not your fault and you choose to process a non-fault claim directly through your insurance company, you will need to pay your policy excess.

However, this doesn’t mean that contacting your insurance company should be your first step after a non-fault accident. In fact, reaching out to an accident claims management company first is often more beneficial. They can expertly handle your claim as an independent party working in your best interest.

An accident management company, such as Elite Accident Management,will ensure that your insurance provider is informed about the accident.

Single Point of Contact: We act as your single point of contact, handling all communications with insurance companies, repair shops, and other parties involved.

An advisor will return your call shortly. Alternatively, you can reach us now at 0778 612 8786.

Rated ‘Excellent’ by our customer

Elit Accident Management(ECM)

122A new road side

horsforth

leeds

ls18 4qb

Registered: 06852246

FCA Regulated: FRN830899

Copyright ⓒ 2024 | Auto Claims Assist Ltd (ACA) | Website by DISRUPT.

Privacy Policy | Cookie Policy | Terms & Conditions | Site Map | Locations